Pacific Prime Fundamentals Explained

Pacific Prime Fundamentals Explained

Blog Article

The Ultimate Guide To Pacific Prime

Table of ContentsExamine This Report on Pacific PrimeThe 8-Second Trick For Pacific PrimeThe Ultimate Guide To Pacific PrimeThe 6-Minute Rule for Pacific PrimePacific Prime for Beginners

Your representative is an insurance coverage specialist with the expertise to guide you with the insurance policy procedure and help you locate the ideal insurance policy defense for you and individuals and things you care regarding a lot of. This write-up is for informational and idea objectives just. If the plan insurance coverage summaries in this write-up problem with the language in the plan, the language in the plan uses.

Policyholder's deaths can also be contingencies, particularly when they are taken into consideration to be a wrongful fatality, along with home damage and/or damage. Because of the uncertainty of stated losses, they are labeled as backups. The guaranteed person or life pays a premium in order to receive the benefits promised by the insurance provider.

Your home insurance coverage can aid you cover the problems to your home and afford the expense of rebuilding or repair services. Often, you can likewise have insurance coverage for products or valuables in your house, which you can then purchase substitutes for with the cash the insurer offers you. In the occasion of an unfavorable or wrongful death of a sole earner, a family members's financial loss can possibly be covered by certain insurance coverage strategies.

Unknown Facts About Pacific Prime

There are numerous insurance coverage plans that consist of cost savings and/or financial investment plans along with routine coverage. These can aid with building cost savings and wide range for future generations through normal or recurring financial investments. Insurance can assist your family members keep their standard of life on the occasion that you are not there in the future.

The most standard kind for this sort of insurance policy, life insurance policy, is term insurance coverage. Life insurance policy generally assists your family members become safe and secure financially with a payout quantity that is offered in the occasion of your, or the policy holder's, death during a details policy period. Youngster Plans This kind of insurance policy is primarily a savings tool that aids with producing funds when children reach particular ages for going after greater education and learning.

Home Insurance coverage This kind of insurance covers home damages in the incidents of accidents, natural catastrophes, and problems, together with various other similar events. international travel insurance. If you are aiming to look for compensation for accidents that have actually taken place and you are battling to identify the appropriate path for you, reach out to us at Duffy & Duffy Regulation Company

How Pacific Prime can Save You Time, Stress, and Money.

At our regulation firm, we recognize that you are undergoing a whole lot, and we comprehend that if you are pertaining to us that you have been with a lot. https://www.webtoolhub.com/profile.aspx?user=42386420. Due to that, we provide you a cost-free appointment to discuss your concerns and see how we can best help you

Due to the COVID pandemic, court systems have actually been closed, which negatively impacts vehicle crash instances in a significant method. We have a great deal of experienced Long Island vehicle accident lawyers that are enthusiastic regarding battling for you! Please contact us if you have any questions or issues. international health insurance. Again, we are right here to help you! If you have an injury case, we intend to ensure that you get the settlement you deserve! That is what we are here for! We happily serve the people of Suffolk Area and Nassau Region.

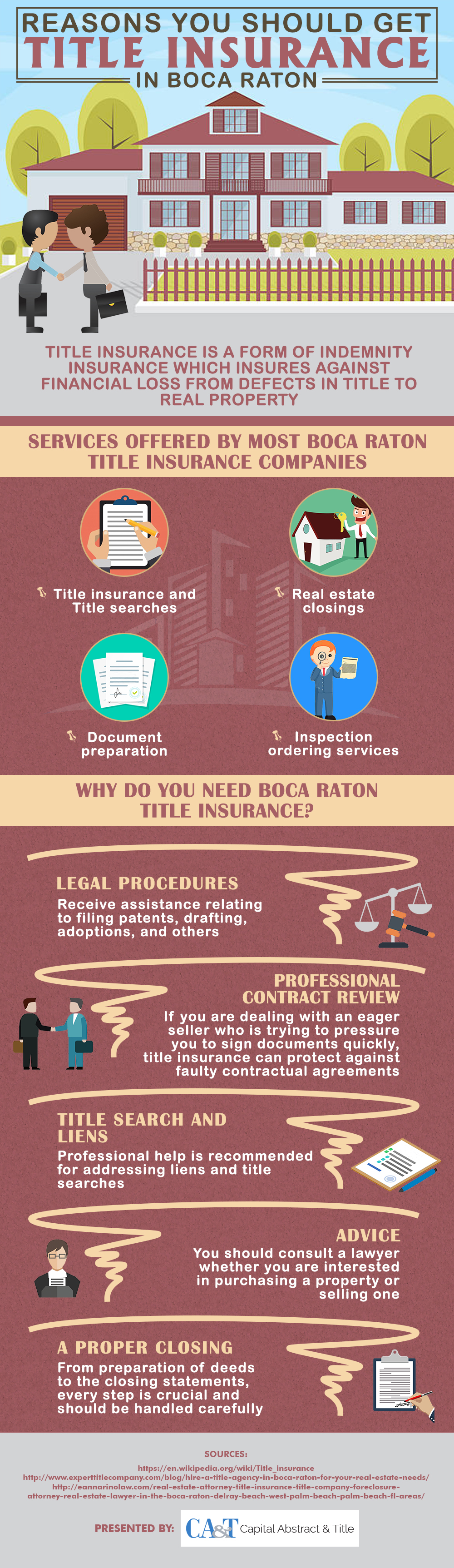

An insurance plan is a legal agreement between the insurance provider (the insurance firm) and the individual(s), business, Check Out Your URL or entity being guaranteed (the insured). Reading your plan aids you validate that the plan meets your requirements and that you understand your and the insurer's responsibilities if a loss occurs. Lots of insureds buy a policy without understanding what is covered, the exemptions that eliminate coverage, and the conditions that need to be fulfilled in order for protection to use when a loss occurs.

It identifies that is the insured, what threats or residential or commercial property are covered, the policy limitations, and the policy duration (i.e. time the policy is in pressure). The Affirmations Web page of a life insurance coverage policy will consist of the name of the person guaranteed and the face quantity of the life insurance coverage plan (e.g.

This is a summary of the major guarantees of the insurance policy firm and specifies what is covered.

The Greatest Guide To Pacific Prime

Life insurance coverage policies are commonly all-risk policies. https://stieuys-rhuiets-scriank.yolasite.com/. The 3 major types of Exemptions are: Left out hazards or reasons of lossExcluded lossesExcluded propertyTypical instances of omitted perils under a house owners policy are.

Report this page